Honoring Legacies of Faith, One Life at a Time!

Giving within the context of a carefully arrived at plan (or in some cases, simply in the course of a given year) can be in many forms - virtually all of which are tax advantaged.

Some of the most popular, and tax-advantaged, methods include:

Appreciated Securities:

- Capital gains tax on the unrealized appreciation of stocks, bonds, or mutual funds held for one year or more can be waived when gifted directly (unsold) to a qualified charity (such as LETU). The full fair market value is tax deductible up to 30% of your adjusted gross income, and any amounts in excess of that can be carried over for up to five years!

Retirement Plan Assets:

- Qualified retirement funds (such as IRA’s) can be taxed at 40% or more if passed on to your heirs at your passing - however, if you pass those distributions directly to a qualified charity (such as LeTourneau University), they can pass tax free - so pass these assets to charity, and give other $$ to heirs!

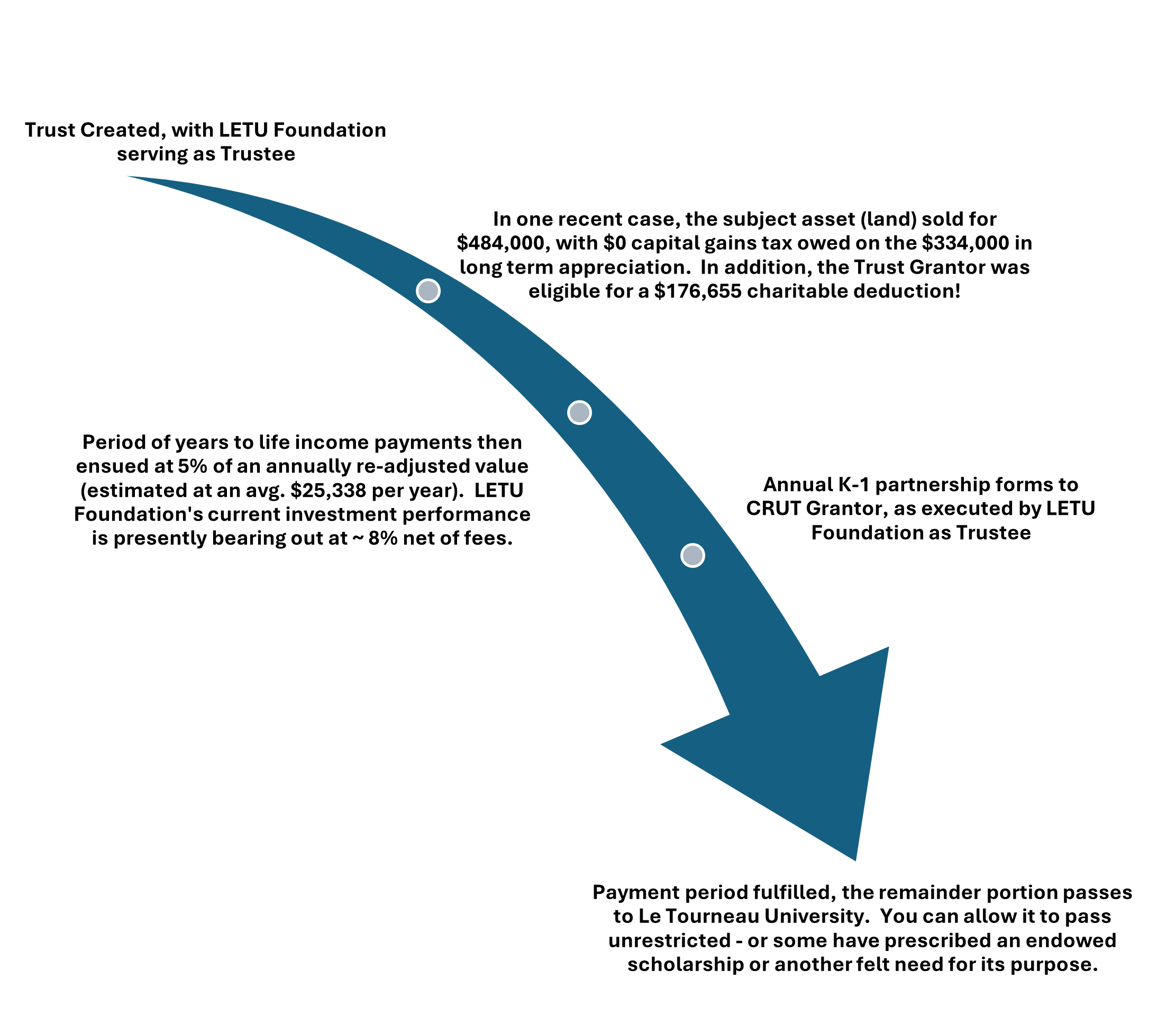

Two-Way (“Split”) Interest, Charitable Unitrusts (“CRUT’s”):

- Gifts of appreciated assets may also be made through a Charitable Remainder Unitrust. These arrangements can provide you or someone you designate an income for life or a fixed term of years, depending upon age. The remainder portion can then be a gift to LETU. See to follow on how one such agreement is in operation for an alumni couple!

Endowed Scholarships:

- Endowed Scholarships can be a meaningful way to assist students. Each agreement can be unique to what you might want to prescribe, qualifying criteria wise, and can be funded by any of the means cited above. Best of all, you will hear from the student you have assisted, giving you the added ability to be a prayer partner for them!

We make it easy!

Please feel free to call upon us for any questions you may have - or for a customized proposal around a scenario you envision. Our proposals are comprehensive and will help facilitate a review between you and your tax advisor - for its actual operation in your unique situation.

We’re available at 800-259-5388, or email leavealegacy@letufoundation.org.

Two-Way (“Split”) Interest, Charitable Unitrusts (“CRUT’s”): “How they work”

“Estate and Legacy Planning” – Does it Really Matter?

Think about this: early in the life of Israel we see the Lord repeatedly reminding them about the importance of passing on to “their children and their children’s children” God’s testimony of faithfulness (Deuteronomy 4:9 and following). God went on to tell the children of Israel that He wasn't’t talking directly with their children, but rather with them – because “their eyes had seen” all that the Lord had done (Deuteronomy 11:2-7).

Estate planning, when done with intentionality and by including a narrative of one’s life, can be an incredible means of motivating future generations. Further empowering such planning with

Watch for our next installment where we will purpose to unpack …

- what estate and legacy planning is

- why it’s important

- what it looks like

and most importantly,

- how it can be a compelling motivation for succeeding generations when it is empowered with an integrated level of charitable gift planning

As always, if we can be of service to you in this area, or for any questions you may have, please do not hesitate to email us at leavealegacy@letufoundation.org or call us toll-free at 903-500-2972 and ask for Tom Bevan.

And always a proper disclaimer: When considering what we might point to by way of a benefit to you in any given situation, always assure to consult your legal and tax advisor for what qualifies as the actual tax treatment of that scenario in your unique situation.

Scholarships play a major role in the lives of LETU students. More than 90% of the student body receives financial assistance from scholarships, grants, and loans. But with graduating seniors incurring significant financial debt, it is our goal to lessen the burden and increase our scholarship aid. Endowed scholarships play a vital role in decreasing the debt burden on students.

Why do LETU alumni and friends choose to establish Endowed Scholarship Funds?

- To perpetuate the memory or legacy of a loved one;

- To honor positive role models who have significantly influenced others;

- To invest in today's students who will influence every workplace and every nation for Christ tomorrow.

Endowed Scholarships provide significant impact:

- Equip leaders for tomorrow today;

- Recruit and retain outstanding students seeking the hands-on, Christ-centered education that has for decades been the strength of LETU;

- Recognize and reward outstanding performance by students with demonstrated financial need.

Endowed professorships, chairs, programs and schools are also available. Call 903.233.3833 to establish your endowment today.

Many companies will match their employees' charitable gifts. Some will even match the donations of retirees or employees' spouses! You can make your money double or even triple and at the same time invest in students' lives.

If your company is eligible, request a matching gift form from your employer's Human Resources department. Complete, sign and send in the completed form with your gift- every time you give a gift! Inform your employer of your donation and give them LeTourneau University's mailing address (2100 S. Mobberly Ave. Longview, TX 75607) so they can make the match. We will do the rest.

Giving a cash gift isn't the only way you can support LeTourneau University students. All you have to do is sign up for all the programs below and then let your shopping do the donating. It's that easy! Your normal, everyday shopping will help the LETU Annual Fund provide scholarship aid to deserving students. Thank you!

Give by Shopping

You're going to buy things anyway, right? Here are some ways your purchase can benefit LeTourneau University.

Amazon Smile

Start your shopping at smile.amazon.com, choose LeTourneau University as your selected organization, and the AmazonSmile Foundation will donate 0.5% of the price of your eligible purchases.

Kroger

If you are a KrogerPlus member, Kroger's Community Rewards program donates a portion of your eligible purchases to the organization of your choice. Choose LETU! Visit https://www.kroger.com/topic/kroger-community-rewards-3 to enroll with your membership card and choose LeTourneau University (NPO# 84780). Don't forget to re-enroll each year to continue in the Community Rewards program.

Tom Thumb

Tom Thumb's Good Neighbor Program allows customers to direct donation dollars to a favorite church, school or other non-profit organization. Visit the courtesy booth at your local store to link your reward card to our account (use our Charity# 9090).

Click here for our Legacy Moments newsletter and videos, with insights on Estate and Legacy Planning

Click here for our Legacy Moments newsletter and videos, with insights on Estate and Legacy Planning